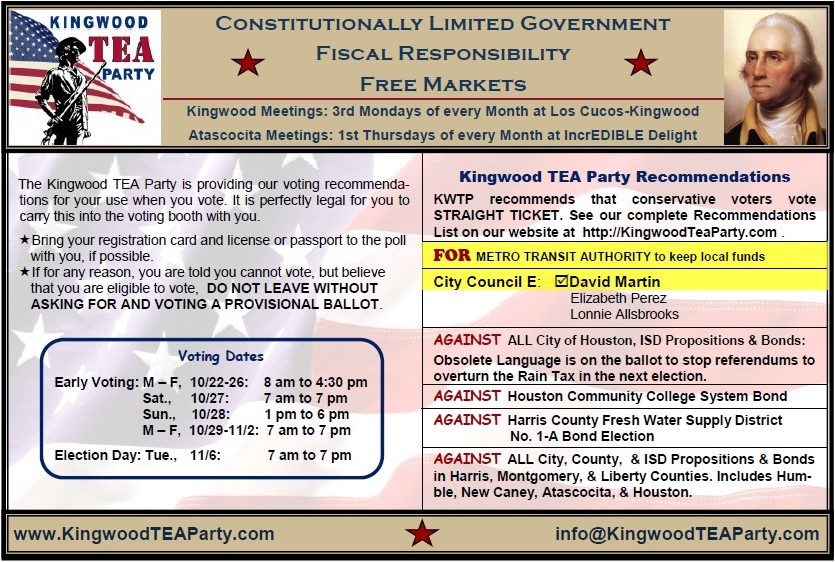

KWTP Complete Recommendations & Dave Martin Recommendation Letter

Complete KWTP Nov. 2012 Recommendations

KWTP Recommendation for City Council E: Dave Martin: Right click and “Save File As” to download.

Kingwood TEA Party Advisory Board Recommends

Dave Martin for Houston City Council, District E

KWTP thanks Elizabeth Perez and Dave Martin for meeting with our Advisory Board. With two conservative candidates competing for the recommendation of the KWTP Leadership Board, it was important to give both the opportunity to fully explain their qualifications, experience, and plans for Houston’s future.

After careful consideration, the Kingwood TEA Party Advisory Board recommends Dave Martin for City Council District E. Several reasons for KWTP’s Advisory Board decision include the following:

- Dave Martin is a long-time resident of Kingwood with a compelling vision for Kingwood’s and Clear Lake’s future.

- Dave Martin’s experiences with Marsh and McLennan, PricewaterhouseCoopers and Ernst and Young demonstrate strong fiscal conservatism, accounting acumen, and outstanding management abilities.

- Dave Martin has been under a conservative microscope as Chairman of the Audit Committee of the Humble Independent School district since 2008, Chairman of the HISD Finance Committee from 2008 to 2012, and as President of the HISD from 2008 to 2010. His actions on behalf of fiscal responsibility and a more effective HISD have been exemplary.

- Dave Martin’s leadership in managing the Turner Stadium project and seeing to that it is managed as if it were a private business generating substantial income and limiting expenses exemplify further his understanding of fiscal responsibility.

- Dave Martin’s had a leading role in bringing the Junior Olympics to Turner Stadium in 2012.

- Dave Martin has acquired useful experience on the Strategic Planning Committee of the Greater Houston Partnership.

Dave Martin demonstrates expertise in auditing, financial reporting and financial analysis; qualities sorely lacking in current members of the City Council. Ultimately, Dave Martin’s long-term vision, ability to understand minutiae, and his conservative values making sure taxpayer dollars are carefully spent for clearly articulated goals for the communities he serves make him the ideal conservative candidate.

KWTP invites you to join us in our support of Dave Martin for Houston City Council, District E.